By Ryan Prete, Jun 11, 2023

Artificial Intelligence is already the star sector of 2023. If an AI startup currently exists, there’s a fair chance that at least one venture capital firm has eyes on it. In the public markets, almost any AI-related company has seen its stock price soar over the past six months. In the private markets, VC and private equity firms are working around the clock to invest in, or acquire, AI companies, in hopes that their firm lands the next unicorn moneymaker.

The AI sector’s valuation has mushroomed over the past year, at a trailblazing pace never seen before. Statista currently value’s the AI sector at $100 billion, and expects that number to explode by twenty fold by 2030, placing its potential value at $2 trillion in under seven years. Venture capital firms completed nearly $240 billion in total deal value in 2022, according to VentureBeat, with that number expected to grow this year, venture capital firms are working to stock their war chests with as many AI companies as possible.

The rapid success of ChatGPT, an AI chatbot service developed by American artificial intelligence research laboratory OpenAI, is the current and overwhelmingly star of the AI sector. ChatGPT, which surpassed 100 million users within its first three months of existence, is a natural language processing tool driven by AI technology that allows users to have human-like conversations, and answer questions and assist with a myriad of tasks including composing emails, essays, and code.

Venture capital and private equity firms have significantly ramped up their investments in artificial intelligence over the past year. Since 2022, an astonishing 15,400 deals in the AI space have been completed by private investment firms, according to PitchBook.

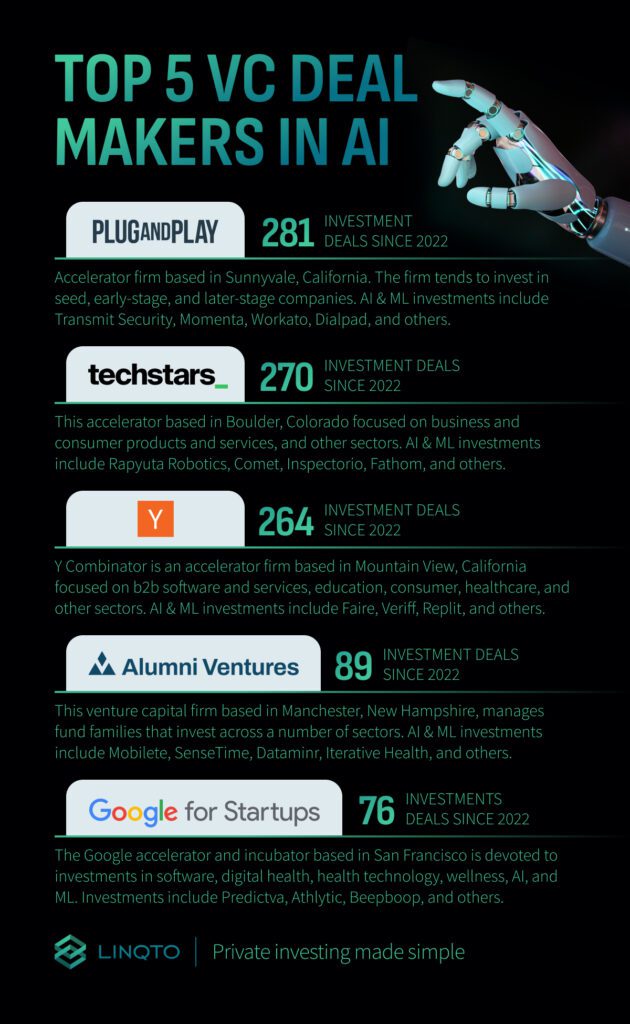

Here are the top ten most active VC firms in the AI sector, according to PitchBook:

Machine learning systems function through programming created by computer scientists, and are “trained” on data, allowing them to make predictions or created responses on new, unseen data. Machine Learning essentially means computer models can automatically learn and improve from data, or by experiencing other programmed tasks. Models learn from inputted data, therefore generating predictions or decisions when tasked with never-before-seen data.

Plug and Play is an accelerator firm based in Sunnyvale, California. The firm tends to invest in seed, early-stage, and later-stage companies. AI & ML investments include Transmit Security, Momenta, Workato, Dialpad, and others.

Investments since 2022: 281

Techstars is an accelerator based in Boulder, Colorado focused on business products, business services, consumer products, consumer services, and other sectors. AI & ML investments include Rapyuta Robotics, Comet, Inspectorio, Fathom, and others.

Investments since 2022: 270

Y Combinator is an accelerator firm based in Mountain View, California focused on b2b software and services, education, consumer, healthcare, and other sectors. AI & ML investments include Faire, Veriff, Replit, and others.

Investments since 2022: 264

Alumni Ventures is a venture capital firm based in Manchester, New Hampshire. The firm manages fund families that invest in companies across a number of sectors. AI & ML investments include Mobilete, SenseTime, Dataminr, Iterative Health, and others.

Investments since 2022: 89

Leverage the power of private equities. Make your move and accelerate your wealth creation journey today!

Google for Startups Accelerator is an accelerator and incubator firm based in San Francisco devoted to investments in software, digital health, health technology, wellness, artificial intelligence, and machine learning sectors. AI & ML investments include Predictva, Athlytic, Beepboop, and others.

Investments since 2022: 76

Tech Incubator Program for Startups is an accelerator firm based in Seoul, South Korea. The firm seeks to invest in seed-stage and early-stage companies. AI & ML investments include Ibizon, Narnia Labs, RealBuy, and more.

Investments since 2022: 71

Insight Partners is a growth private equity firm based in New York, New York. The firm predominately invests in technology. AI & ML investments include BMC Software, Databricks, Transmit Security, Dataiku, and others.

Investments since 2022: 68

10X Capital is a venture capital firm based in New York. The firm invests in information technology and big data sectors. AI & ML investments include FiscalNote Holdings, Cerebras, Shield AI, Epirus, and others.

Investments since 2022: 62

Antler is an accelerator and incubator firm based in Singapore and seeks to invest in the technology sector. AI & ML investments include Vamstar, Bluesheets, Glint Solar, and others.

Investments since 2022: 61

Ready to Invest? Discover Investment Options Today.

Goodwater Capital is a venture capital firm based in Burlingame, California. The firm invests in housing, financial services, consumer products and services, healthcare, food, transportation, and other sectors. AI & ML investments include ByteLearn, EthSign, DealDriver AI, and others.

Investments since 2022: 61

Linqto offers an array of artificial intelligence offerings, including AI cloud for contact centers ASAPP, retail AI startup Standard AI, generative AI platform SambaNova, and complex artificial intelligence deep learning application developer Cerebras Systems.

Investors in these three AI startups include Temasek, GIC, BlackRock, Altimeter Capital, Benchmark Capital, Coatue Management, SK Networks, TI Platform Management, and many others.

In the ever-evolving landscape of venture capital, AI companies have emerged as a top priority for institutional investors.With boundless potential for innovation and transformative impact, these investments promise lucrative returns. As VC firms increasingly recognize the power of artificial intelligence, embracing this technological frontier becomes a strategic imperative for unlocking future success in the dynamic world of investment. Have thoughts or experiences to share on this topic? Dive into the discussion and leave your insights in the comments section below!

This material, provided by Linqto, is for informational purposes only and is not intended as investment advice or any form of professional guidance. Before making any investment decision, especially in the dynamic field of private markets, it is recommended that you seek advice from professional advisors. The information contained herein does not imply endorsement of any third parties or investment opportunities mentioned. Our market views and investment insights are subject to change and may not always reflect the most current developments. No assumption should be made regarding the profitability of any securities, sectors, or markets discussed. Past performance is not indicative of future results, and investing in private markets involves unique risks, including the potential for loss. Historical and hypothetical performance figures are provided to illustrate possible market behaviors and should not be relied upon as predictions of future performance.