By Ryan Prete, Oct 30, 2023

Table of Contents

In this blog, we unravel the concept of market cycles and their pivotal impact on investment decisions. By exploring the economic expansions and contractions, and outlining the strategic approaches necessary for successfully needed to navigate the financial landscape, we provide invaluable insights. We aim to provide valuable insights, whether you’re a seasoned investor or just starting, into the world of market cycles and their influence on both private and public markets.

Market cycles, characterized by recurring fluctuations in financial markets, reflect the dynamic nature of economic activity and investor behavior. They encapsulate variations in asset prices, market sentiment, and broader economic conditions, being influenced by diverse factors such as economic indicators, geopolitical events, and central bank policies.

For investors and financial analysts, understanding market cycles is indispensable. It informs investment decisions and risk management strategies, allowing investors to tailor their approach on the market’s position within a cycle. Knowledge of market cycles not only offers historical context, but also aids in the assessment of market trends and potential outcomes. Each phase of a market cycle, while structured, is subtly influenced by specific market conditions and external events, making a nuanced understanding essential for navigating the market’s complexities and making informed investment decisions.

To understand the complex phenomena of market cycles, and how they shape the behavior of financial markets over time, we must first define the four key stages.

Often synonymous with a “bull market,” expansion heralds a period thriving with economic potential and energy. It is characterized by several significant features:

Step into the high-reward world of private equities. Don’t wait, your portfolio expansion starts here!

The “peak” is a critical stage in the market cycle and often marks the highest point of economic and market activity, it can be classified by the following characteristics:

The “contraction” phase is a crucial stage in the market cycle and represents a period of economic and market decline following the peak. Here’s a more detailed explanation of this phase:

Leverage the power of private equities. Make your move and accelerate your wealth creation journey today!

Lastly, is the pivotal “trough” stage, which marks the lowest point of economic and market conditions. The trough underscores the cyclical nature of financial markets and the broader economy, where periods of pessimism and economic weakness are typically followed by renewed optimism and growth. The trough can be characterized by the following:

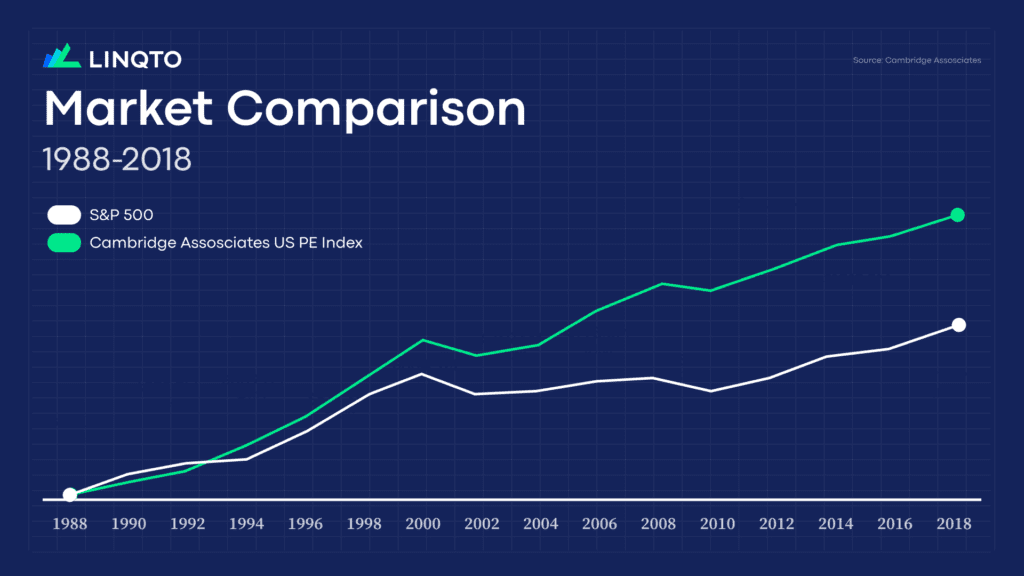

Private equity funds have consistently outperformed the S&P 500 for several reasons. One key factor is the longer investment horizon typically associated with private equity. These funds invest in companies with the intention of holding and nurturing them over several years. This extended period allows private equity firms to focus on value creation and operational improvements within their portfolio companies. Unlike public market investors who may be subject to the pressures of quarterly earnings reports, private equity investors can take a patient, strategic approach to maximize returns.

Active management is another crucial element in their outperformance. Private equity funds often take a hands-on role in managing their investments. They work closely with the management teams of their portfolio companies, making strategic decisions and driving operational improvements. This level of engagement can lead to substantial value creation, which is not always possible for passive investors in public markets.

Furthermore, private equity funds invest in private markets, which are not subject to the same level of market volatility and short-term investor sentiment as publicly traded stocks. This insulation from market cycles allows private equity investments to be more resilient in the face of economic downturns.

Investors should not be overly worried about market downturns for several reasons.

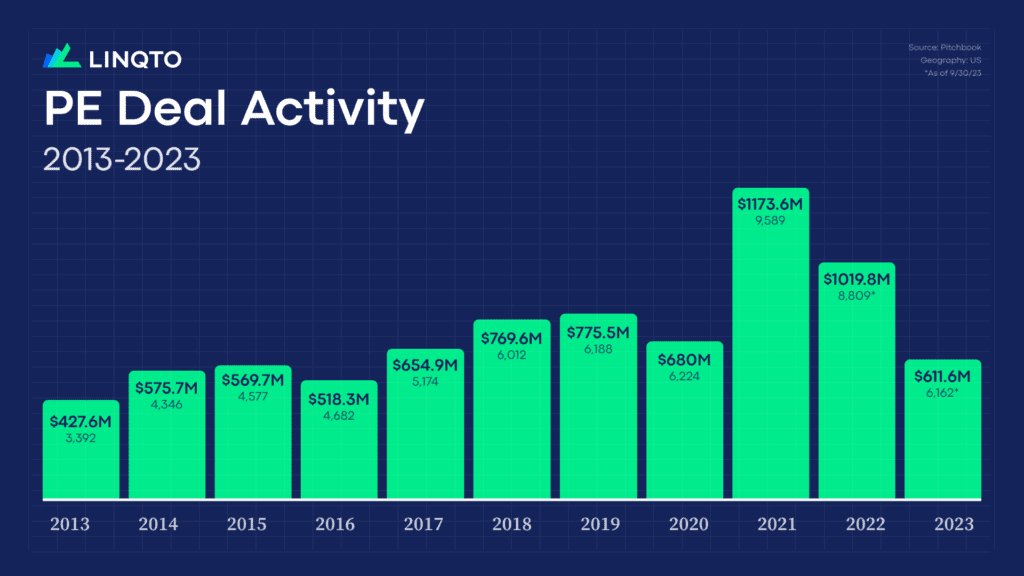

Take a look at the chart above, notice how the private equity deal flow moves with performance of the global market. When performance is dipping, it can feel like positive returns are far out of reach, but when investors look at the big picture, they’ll notice an overall climb of the market. Downturns are inevitable, but complete progress of the private and public markets has been positive on average from year-to-year.

The length of a market cycle is inherently variable, without a fixed duration. Cycles can span from a few years to over a decade, influenced by a multifaceted array of factors such as economic conditions, monetary policies, and global events. A complete market cycle encompasses diverse phases, including expansion, peak, contraction, and trough, each varying in duration and influenced by dynamic economic variables, regulations, and investor behaviors.

Investment strategies during market cycles should ideally be continuous and adaptive. Timing the market perfectly is extremely challenging, and attempting to do so can result in missed opportunities.

A disciplined investment approach, characterized by regular contributions and a diversified portfolio can help manage risk. Such a strategy not only helps in managing risks but also allows investors to leverage potential downturns as valuable entry points and benefit from gains during market upsurges. This continuous investment approach, aligned with long-term objectives, can help mitigate the impacts of transient market volatilities, fostering a resilient wealth-building journey.

Understanding and navigating market cycles is essential for all investors. By embracing the inevitability of economic ups and downs, staying informed, and maintaining a disciplined, long-term perspective, investors can make more informed decisions and confidently navigate the ever-changing financial landscape. For further insights and education, we invite you to explore Linqto’s blog page.

This material, provided by Linqto, is for informational purposes only and is not intended as investment advice or any form of professional guidance. Before making any investment decision, especially in the dynamic field of private markets, it is recommended that you seek advice from professional advisors. The information contained herein does not imply endorsement of any third parties or investment opportunities mentioned. Our market views and investment insights are subject to change and may not always reflect the most current developments. No assumption should be made regarding the profitability of any securities, sectors, or markets discussed. Past performance is not indicative of future results, and investing in private markets involves unique risks, including the potential for loss. Historical and hypothetical performance figures are provided to illustrate possible market behaviors and should not be relied upon as predictions of future performance.