From analysis to executing your first investment, Linqto has been built with our members in mind.

Get StartedWe’re invested, just like you

We assess the risk and make the investment, then we deliver the opportunity to you. We have skin in the game.

Our originations team is tirelessly on the hunt for the next standout pre-IPO venture. By identifying a diverse range of companies across various industries that are primed for a successful IPO debut, we aim to bring you the most promising opportunities.

We delve into the financials, engage in discussions with the leadership, and scrutinize the market for a comprehensive risk assessment. Our analysis is both quantitative and qualitative, ensuring a holistic understanding of the potential and challenges associated with each opportunity.

After making our own investment and presenting the opportunity to our members, we remain vigilant in monitoring each company. We also persistently update the market insights provided to you, ensuring that you have access to the most current and relevant information.

Invest simply, from anywhere

See how we deliver on our company’s promise: Private Investing Made Simple

Sign Up Your Way

Simply sign up the way you want to using Google, Apple or your email.

Easily Fund Your Wallet

With many ways to add funds to your wallet, we make it simple to be sure you can invest when you want to.

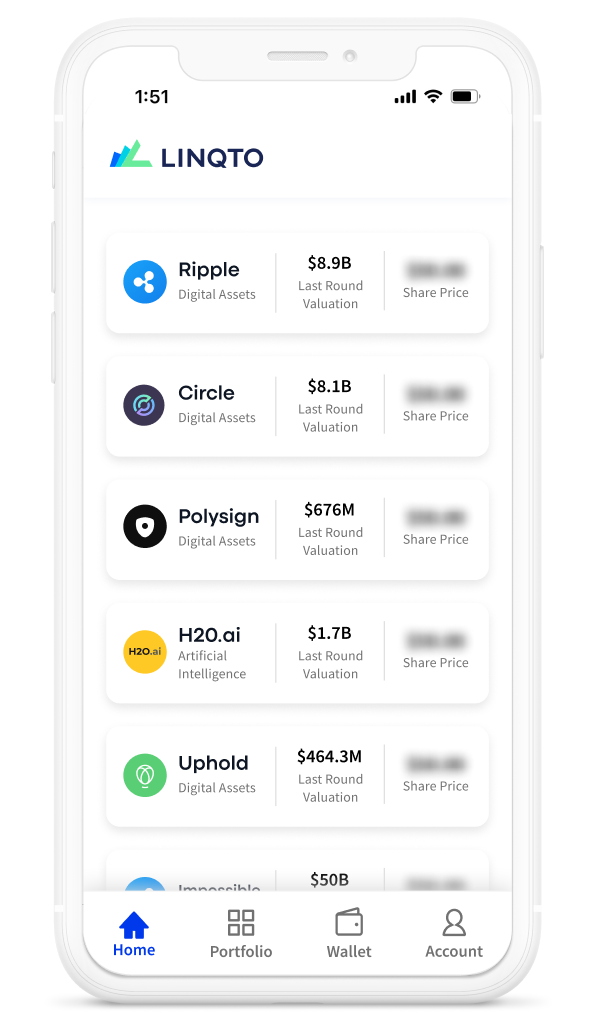

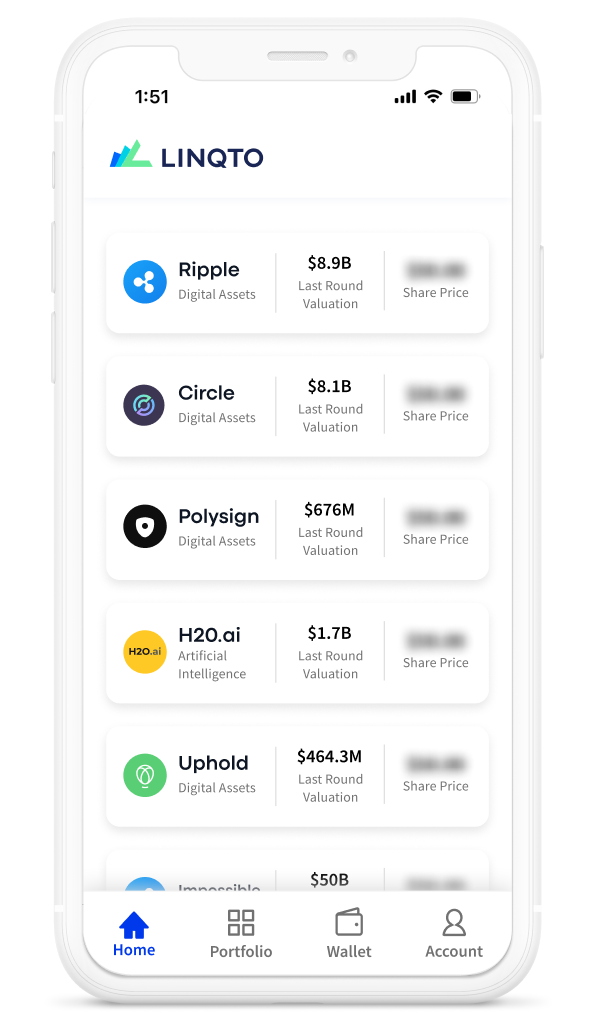

Browse Investments

Once signed up, you gain access to comprehensive company data including valuation, funding rounds, leadership, and more.

Manage Your Portfolio

Your portfolio will always show you everything you have in your account.

Get Liquidity

Enjoy peace of mind when you invest, knowing that you don't have to wait for an IPO to get liquidity when you need it (on most popular investments).

Real people, real experiences

“The process of creating and funding my account and also purchasing stock was very easy with a straightforward web design. Quick responses to emails when I had questions. Personal outreach to connect and speak to Linqto professionals and overall positive tone in all interactions.”

William B

Member since 2022

“Access to early-stage/pre-IPO companies. Relatively easy to engage, sign-up, fund, learn and invest.”

Bradford P

Member since 2023

“Alan my account representative was extremely helpful and answered all questions we had for him and responded very quickly, will be making more investments soon.”

Nick P

Member since 2023

Getting Started

Step

Verify Your Identity

A quick photo of your government I.D. (e.g. Passport, National ID or drivers license) and a self-photo. Then provide just a few more details about yourself. This helps protect the security of our platform.

Step

Accreditation

Indicate if you qualify as an accredited investor, and provide documentation to help us verify (if applicable). This keeps our platform compliant with financial regulations. Find out more by reading our FAQs.

Step

Invest at Small Minimums

Fund your investment from your bank account via ACH or wire, your Uphold Wallet. It’s up to you! You can also use your retirement or business account. Ask us how!

you're in control

What sets Linqto apart is our commitment to providing our members with control. While traditional private equity platforms leave you waiting for an exit event, like an IPO or acquisition, Linqto enables you to take control. We provide liquidity, giving you the power to buy and sell your shares directly on our platform. This means you're not just investing and waiting; you can actively monitor and manage your portfolio to optimize your investment strategy.

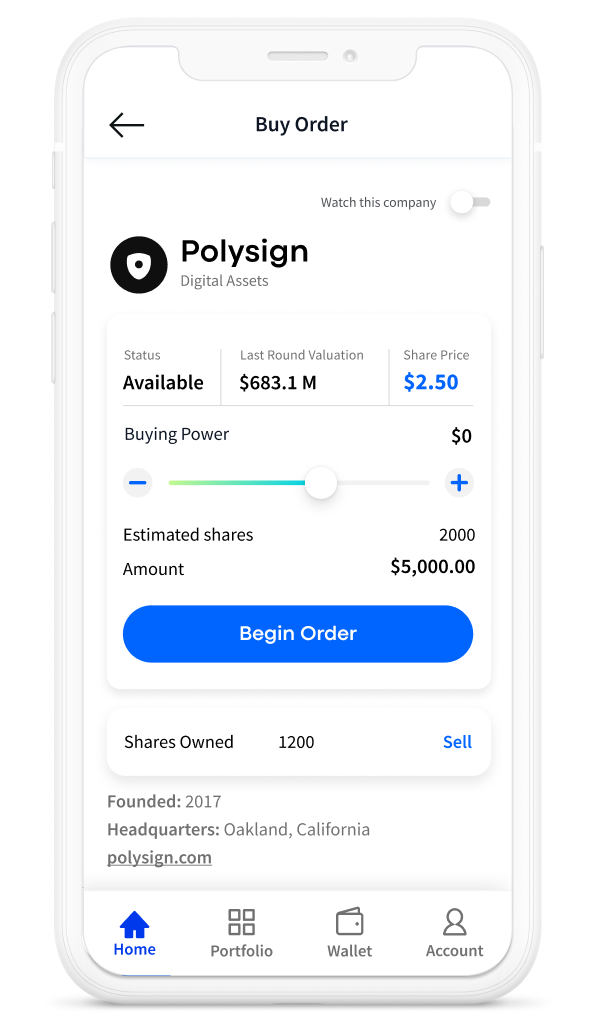

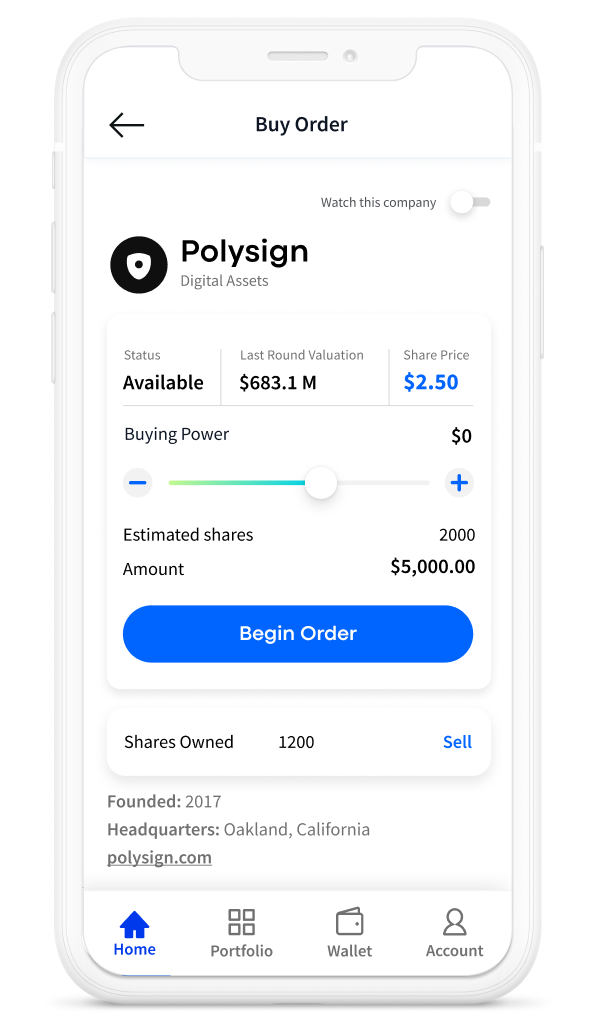

Find us in the app store

The Linqto mobile app enables our members to invest in pre-IPO companies and manage their investments from anywhere, at any time. The easy-to-navigate interface provides a seamless user experience, whether you're browsing investment opportunities or tracking the performance of your portfolio.

Our commitment to democratizing private equity investing extends to the palm of your hand. With Linqto, the power to invest, monitor, and actively manage your private equity portfolio is literally at your fingertips, no matter where you are.