By Ryan Prete, Jun 29, 2023

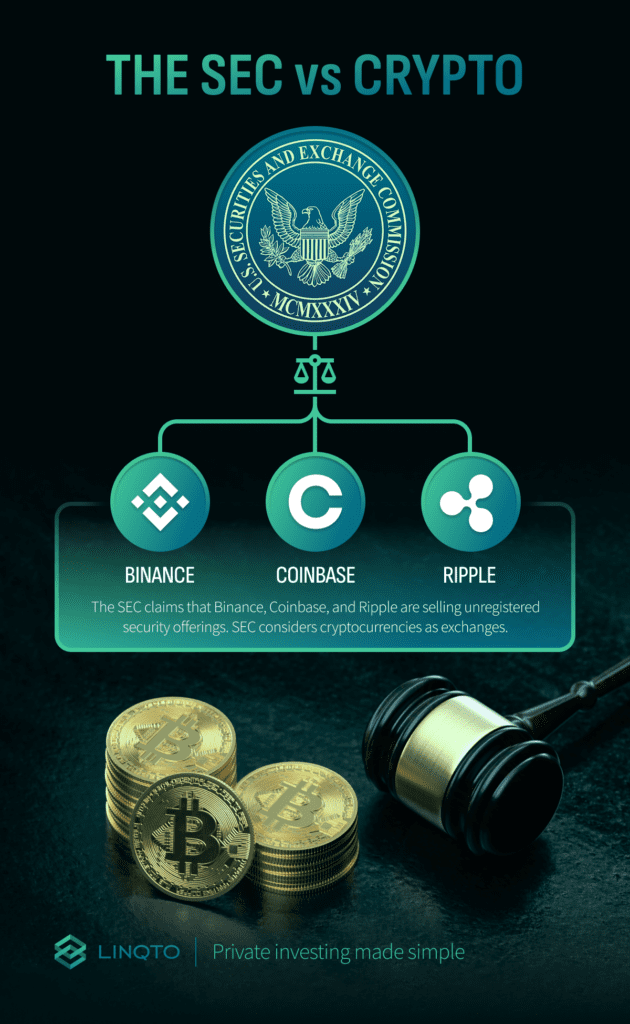

The Securities and Exchange Commission has—very publicly—filed a handful of separate lawsuits against different cryptocurrency firms which operate in the U.S. The Commission’s argument in each lawsuit is essentially the same: that the cryptocurrencies offered by the accused firms and exchanges are securities, not commodities, and should therefore be taxed and regulated as such. Lets take a look at the current open cases against Ripple, Coinbase, and Binance, and where each presently stand.

The case that has garnered the most attention—and is of course the most prevalent to Linqto members—is the SEC’s lawsuit against Ripple. Filed in December 2020, the case alleges that Ripple raised more than $1 billion in 2013 through the sale of XRP (its token) in an unregistered security offering to its investors.

This case is so important for a number of reasons, as it sent shockwaves through the cryptocurrency sector as the most high-profile attempt by a federal regulator to target an initial coin offering, or ICO. The future of how the U.S. government treats cryptocurrency essentially hinges on this case.

In the lawsuit, the SEC claims that Ripple never filed the necessary registration documents it requires for companies in the stock market that are seeking to raise capital from the public. Of course, Ripple isn’t a public company and has repeatedly and vehemently denied that XRP is a security.

In an effort to prove that XRP is in fact not a security, Ripple has relied on a number of key resources, chiefly is the evidence present in the “Hinman Speech documents.” The documents which the SEC has tried to have sealed, consist of emails related to a speech given by William Hinman, the former Director of the SEC’s Division of Corporation Finance. In the speech, which occurred over four years ago, Hinman reportedly stated that the SEC did not consider ether a security. As a result, Ripple’s lawyers argue that Hinman’s comments should impact how the agency views XRP’s own status as a cryptocurrency.

According to Ripple CLO Stuart Alderoty, Hinman ignored offered advice, instead pushing a speech that “was divorced from the Howey factors, exposed regulatory gaps, and would create not just confusion, but ‘greater confusion’ in the market.”

The Howey test refers to the U.S. Supreme Court case SEC v. Howey which is now used to determine whether a transaction is deemed an “investment contract,” and therefore would be considered a security under the Securities Act of 1933 and the Securities Exchange Act of 1934. Crucial to the test is whether an investment contract exists if there is an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

In May Judge Analisa Torres’ ruled to formally deny the SEC’s motion to formally seal the documents, a major win for Ripple’s defense. The case is still open, and a decision, or settlement has been expected since the Spring. Linqto is constantly monitoring the case and will be sure to update our members as swiftly as new information is made available. It’s important to note that Ripple’s has also been elevated by over a dozen amici briefs, filed by notable parties, in support of Ripple. Among these voluntary filings is Coinbase, a major cryptocurrency exchange who argues that XRP is in fact not a security. The SEC has since filed its own lawsuit against Coinbase, which we will explore next

Interested in investing in Cryptocurrency Companies?

On June 6, the SEC formally sued Coinbase, the second-largest crypto exchange by volume, on allegations that the exchange operated its crypto asset trading platform as an unregistered national securities exchange and broker. The SEC also alleges at least 13 crypto assets that Coinbase made available to customers, including Cardano and Solana’s tokens, qualify as “crypto asset securities,” according to the complaint.

According to the complaint, the SEC argues that Coinbase’s staking program, also counts as an investment contract and unregistered security.

Following the case’s filing, Coinbase co-founder and CEO Brian Armstrong highlighted that the SEC and Commodity Futures Trading Commission (CFTC) “have made conflicting statements, and don’t even agree on what is a security and what is a commodity.”

“Regarding the SEC complaint against us today, we’re proud to represent the industry in court to finally get some clarity around crypto rules, Armstrong stated.

Coinbase general counsel Paul Grewal told CNBC that Coinbase would continue to operate its business as usual while the case remains open.

“The SEC’s reliance on an enforcement-only approach in the absence of clear rules for the digital asset industry is hurting America’s economic competitiveness and companies like Coinbase that have a demonstrated commitment to compliance,” Grewal said. Investors haven’t seem fazed by the SEC lawsuit against the cryptocurrency exchange giant, as Coinbase’s stock has climbed over 37% since the case was filed on June 6.

A day before the SEC officially sued Coinbase, it announced a lawsuit against Binance, the world’s largest cryptocurrency exchange in terms of daily trading volume. In the 136-page complaint, the Commission alleged that Binance was involved in the sale of unregistered securities, and that its founder Changpeng “CZ” Zhoa participated in a complex conspiracy that involved fraud, conflicts of interest, a lack of disclosure, and willful disregard for the law. The long list of accusations falls right in line with Chairman Gensler’s ideology of cryptocurrencies and marked what could be one of the SEC’s largest cases to date.

In response to the lawsuit, Binance’s attorney Daniel W. Nelson said that there is no risk to Binance’s customer assets, despite the SEC’s assertions.

“Indeed, there is no ‘emergency’ here at all, other than the one manufactured by the SEC for its own purposes, when the alleged securities law violations, according to the SEC, have been going on publicly and openly for years,” Nelson said in a formal motion.

Binance has since fired back at the SEC, with its lawyers filing more than 20 motions and declarations, questioned the timing of the SEC’s charges, which coincided with a lawsuit targeting Coinbase.

In a filing to the US District Court for the District of Columbia, Binance’s lawyers argued that the court “should not permit the SEC to inflict harm in the United States and worldwide by enacting the drastic relief sought by the SEC on an incomplete record and expedited schedule.”

Looking to Invest? Discover Investment Options Today.

With any form of litigation comes a waiting game. Like Ripple’s continuing case, these other lawsuits could go on for years, especially for cases of this magnitude, which have the ability to affect the cryptocurrency sector as a whole.

The best way to stay up to date on the Ripple case is to check Linqto’s website and emails for updates, as we work around-the-clock to provide our members on updates to Ripple, a transformative company with whom we stand with.

This material, provided by Linqto, is for informational purposes only and is not intended as investment advice or any form of professional guidance. Before making any investment decision, especially in the dynamic field of private markets, it is recommended that you seek advice from professional advisors. The information contained herein does not imply endorsement of any third parties or investment opportunities mentioned. Our market views and investment insights are subject to change and may not always reflect the most current developments. No assumption should be made regarding the profitability of any securities, sectors, or markets discussed. Past performance is not indicative of future results, and investing in private markets involves unique risks, including the potential for loss. Historical and hypothetical performance figures are provided to illustrate possible market behaviors and should not be relied upon as predictions of future performance.