By Sunita Arnold, Nov 2, 2023

Pre-IPO stocks allow investors to gain exposure to private companies before they go public. Imagine being an early employee at a successful startup, having received stock options as part of your compensation package. Over time, the value of those options has grown significantly, and you’re now considering selling some of your pre-IPO stock to reap the rewards of your hard work and dedication. But where do you start? How do you navigate the world of pre-IPO stock sales while maximizing your potential gains and minimizing risks? This guide will explain how to sell pre-IPO stock through secondary markets or other avenues, walking you through the ins and outs of selling pre-IPO stock and exploring various methods, factors to consider, and even alternatives to selling your shares.

To make informed decisions about selling pre-IPO stock, it’s important to first understand the basics of what pre-IPO stock is and the potential upsides and downsides. This section will provide an overview of pre-IPO stock, reasons investors may find it appealing, and the key risks involved with investing in private company shares that need to be evaluated. Gaining this foundational knowledge can help guide your approach to selling pre-IPO stock.

Pre-IPO stock refers to the private company shares, or private stock, that are sold to investors before the company goes public through an initial public offering (IPO). These private sales of shares, also known as secondary transactions, allow early investors, employees, and even the general public to purchase shares at a potentially lower price before the company is publicly traded. Investing in pre-IPO stock can be an attractive option for those who believe in the future success of a company and are willing to take on the inherent risks associated with such investments.

However, it’s important to recognize that investing in pre-IPO stock carries a greater degree of risk compared to investing in publicly traded companies due to limited access to information regarding the company’s performance and potential for success. This lack of transparency may make it more difficult for investors to make informed decisions and evaluate the true value of their shares. Considering personal financial goals, tax implications, and any company restrictions is an integral step towards fully comprehending the potential benefits and challenges of investing in pre-IPO stock.

One of the primary reasons investors choose to invest in pre-IPO shares, also known as private shares, is the potential for significant returns should the company prove to be successful. By purchasing shares before the company goes public, investors may acquire shares at a discounted rate, which could result in increased returns if the company’s stock appreciates in value once it is listed on a stock exchange.

Despite the potential for high returns, investing in pre-IPO shares comes with its own set of risks, such as lack of liquidity, the possibility of dilution, and the chance that the company may not succeed. Investors need to balance these risks against the potential rewards, making an informed decision that reflects their risk tolerance and financial objectives.

Step into the high-reward world of private equities. Don’t wait, your portfolio expansion starts here!

Investing in pre-IPO stock comes with several risks that potential investors should be aware of. One major risk is the lack of liquidity associated with pre-IPO stock. Since these shares are not traded on public stock exchanges, it may be challenging to find a buyer or seller, making it difficult for investors to cash out their investments when needed. This limited liquidity may also result in a wider bid-ask spread, which could impact the overall return on investment.

Another risk associated with pre-IPO stock is the limited information available to investors regarding the company’s performance and outlook. Unlike publicly traded companies, private companies are not required to disclose as much information to investors, which may make it difficult for investors to make informed decisions about their investments. Additionally, there is always the risk that the company may not succeed or meet expectations, potentially leading to a total loss of investment. Therefore, before investing in pre-IPO stock, investors must be thorough in considering these risks.

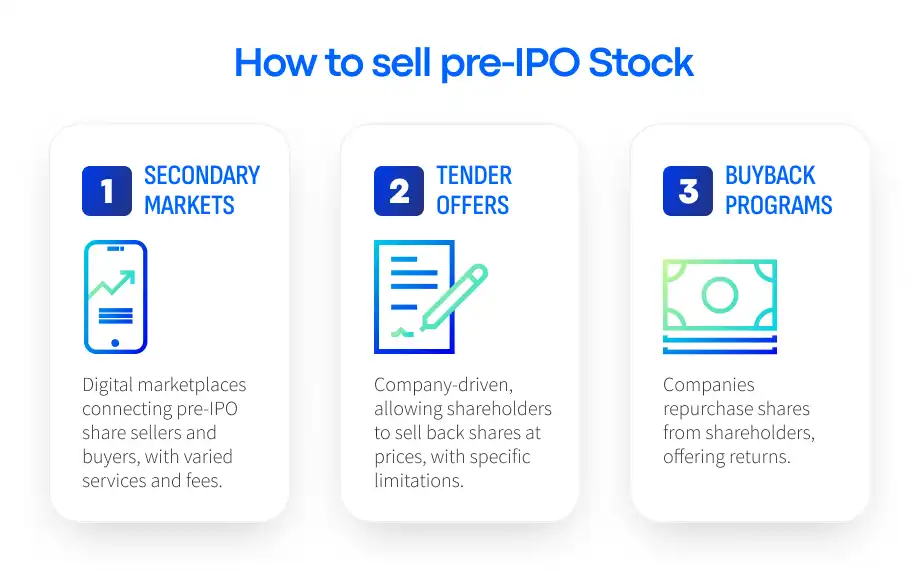

Now that you have a better understanding of the nature of pre-IPO stock and the associated risks, let’s explore the various methods to sell pre-IPO shares. This segment will cover potential avenues for divesting your pre-IPO stock, such as secondary market platforms, tender offers, and buyback programs.

Secondary market platforms have revolutionized the way investors access potential pre-IPO shares of private companies. These digital marketplaces act as a conduit connecting sellers with buyers, streamlining transactions in both primary and secondary markets.

Various platforms offer an array of services, with considerations such as transaction sizes, fees, and commission structures that play a pivotal role in shaping the investor’s experience and overall returns. The intricate nature of transactions and the time involved can also influence the decision-making process, steering the trajectory of investments in the pre-IPO landscape.

A tender offer is a company-organized liquidity event that allows shareholders to directly sell back their shares at a set price.

Tender offers have the following characteristics:

While tender offers can provide a viable method for selling pre-IPO stock, it’s important to be aware of the potential limitations and restrictions associated with this method. For instance, the company may have the right of first refusal (ROFR), meaning they have the option to repurchase the shares before allowing them to be sold to other potential buyers. Additionally, tender offers are subject to company approval and may not always be an option.

Buyback programs are another method for selling pre-IPO stock, allowing companies to repurchase their own shares from shareholders, thereby providing an additional return to investors. Buyback programs can be an attractive option for shareholders looking to divest their pre-IPO stock, as they do not require the use of secondary market platforms or tender offers. However, like tender offers, buyback programs may not always be available as a method for selling pre-IPO stock, and they may not offer the best price for the shares.

Shareholders must thoughtfully weigh the potential benefits and drawbacks of using buyback programs when deciding to sell their pre-IPO stock. While buyback programs can provide a means for selling shares, they may not always offer the most favorable price or be available as an option for all shareholders. As such, it’s important to explore all available methods for selling pre-IPO stock and choose the one that best aligns with your financial goals and risk tolerance.

Now that we’ve explored various methods for selling pre-IPO shares, let’s discuss some essential factors to evaluate before making a decision.

We make it easy for you to sell us your privately held shares of companies

Before embarking on the journey of selling your pre-IPO stock, consider several factors that can impact your decision-making process. This section will cover personal financial goals, tax implications, and company restrictions. These factors should be carefully evaluated before deciding to sell your pre-IPO shares.

Assessing your personal financial goals and liquidity needs is a critical aspect of determining whether selling your pre-IPO stock is the right decision for you. It’s important to strike a balance between the benefit of having cash in hand now and the potential value of your shares increasing over time. Additionally, consider your motivation for liquidating your shares, such as a down payment on a house or other financial goals, and weigh the potential benefits and risks of selling your pre-IPO stock against these goals.

Creating a financial plan is a helpful way to evaluate whether selling your pre-IPO stock aligns with your long-term financial objectives. By carefully considering your current financial situation, long-term objectives, and the potential risks and rewards associated with selling pre-IPO stock, you can make a more informed decision about whether this option is the right choice for you.

Another important factor to consider when selling pre-IPO stock is the potential tax implications of the transaction. Depending on the type of stock option granted, you may owe taxes at exercise and sale or only at sale. It’s important to consult with financial and tax advisors to evaluate the tax consequences of selling your pre-IPO stock, as the implications can vary depending on your individual circumstances.

For example, when exercising stock options, you may be subject to ordinary income tax on the difference between the exercise price and the fair market value of the shares at the time of exercise. When selling pre-IPO stock, you may find yourself subject to capital gains tax. This is based on any rise in the fair market value of the shares since the time they were exercised. Understanding and planning for these tax implications, including the need to pay ordinary income tax, can help you make a more informed decision about whether selling your pre-IPO stock is the right choice for you.

In addition to personal financial goals and tax implications, it’s essential to understand any restrictions your company may have in place regarding the sale of pre-IPO stock. Some common restrictions include:

It’s important to familiarize yourself with these restrictions to ensure compliance when selling pre-IPO stock.

Before attempting to sell your pre-IPO stock, make sure to familiarize yourself with your company’s specific restrictions and guidelines. Failing to do so could result in penalties or other legal actions. By taking the time to understand and comply with your company’s restrictions, you can minimize potential complications and ensure a smoother transaction process when selling your pre-IPO shares.

Now that you have a deeper understanding of the factors to consider before selling your pre-IPO stock, let’s delve into the process of divesting your shares. This part will guide you through the following steps:

The first step in selling your pre-IPO stock is to obtain approval from your company. Many private companies have restrictions in place that require shareholders to seek approval before they can sell private company stock. To obtain company approval, you will need to contact the company’s board of directors or other designated representatives and provide all the necessary information and documents required for the approval process.

Keep in mind that the approval process may vary depending on your company’s specific requirements and restrictions. It’s essential to ensure that you are fully aware of and compliant with your company’s guidelines before attempting to sell your pre-IPO stock. Failure to secure company approval before selling your shares could result in penalties or other legal actions.

Once you have obtained company approval, the next step in selling your pre-IPO stock is to determine the value of your shares. Obtaining an accurate valuation of your shares is essential to ensure you receive a fair price for your investment. You can obtain the valuation of your pre-IPO stock either through the company itself or by using a private valuation service.

The value of your pre-IPO stock is typically based on the most recent assessment of the company’s fair value, which takes into account factors such as the company’s financial performance, market conditions, and potential for growth. Keep in mind that the value of your pre-IPO stock may differ from the fair market price, so it’s important to have a clear understanding of the valuation process and how it impacts the potential return on your investment.

With an accurate valuation in hand, the next step in selling your pre-IPO stock is to find a buyer for your shares. There are several methods for finding a buyer, including utilizing secondary market platforms like Forge Global or EquityZen, participating in tender offers organized by the company, or exploring buyback programs. Each of these methods has its own set of benefits and drawbacks, so it’s important to carefully consider which option best aligns with your financial goals and risk tolerance.

When selecting a method for finding a buyer, consider factors such as the platform’s minimum transaction size, fees, and the potential pool of buyers. Additionally, be aware of any company restrictions or requirements that may impact your ability to sell your shares, such as the right of first refusal or specific rules during buyback or tender offer programs.

After finding a buyer for your pre-IPO stock, the final step in the process is to complete the transaction. This may involve working with the buyer, the company, and any relevant advisors or legal professionals to ensure that all necessary paperwork and legal requirements are met.

Throughout the transaction process, it’s essential to stay organized and maintain clear communication with all parties involved. By doing so, you can help minimize potential complications and ensure a smooth and successful transaction.

With the proper planning and execution, selling your pre-IPO stock can be a rewarding experience that allows you to capitalize on your investment and achieve your financial goals.

In some cases, selling pre-IPO stock may not be the best option for your financial situation or goals. This section will delve into alternatives to selling pre-IPO stock, such as non-recourse financing and cashless exercise. Depending on your individual circumstances, these alternatives may offer additional flexibility and benefits.

Non-recourse financing is a type of loan that uses your pre-IPO shares as collateral, providing liquidity without the need to sell your shares. This type of financing can be an attractive option for those looking to retain their shares for the long-term while still accessing the liquidity they need to meet their financial goals or cover expenses.

However, non-recourse financing comes with its own set of risks and considerations. For example, if the loan is not repaid, the lender can take possession of the shares used as collateral. Additionally, the terms of the loan may be unfavorable, including high interest rates or short repayment periods. Before pursuing non-recourse financing, it’s important to carefully evaluate the terms and risks associated with this option and consult with financial advisors to determine if it’s the right choice for your situation.

Cashless exercise is another alternative to selling pre-IPO stock, which allows you to exercise your private company stock options without having to provide the full exercise price upfront. In a cashless exercise, you would sell a portion of your option grants to cover the cost of exercising the remaining options, without having to pay the exercise cost out of pocket.

This option can be particularly attractive for those who want to retain ownership of their shares but may not have the funds available to cover the exercise cost. However, it’s important to carefully consider the potential tax implications and other factors associated with a cashless exercise before pursuing this option.

In conclusion, selling pre-IPO stock can be a complex but potentially rewarding process for investors looking to capitalize on their early investments in successful startups. Before deciding to sell your pre-IPO shares, it’s essential to understand the nature of pre-IPO stock, its potential benefits and risks, and the various methods available for selling your shares.

By carefully considering your personal financial goals, tax implications, and company restrictions, and navigating the selling process with diligence and organization, you can make a more informed decision about whether selling your pre-IPO stock is the right choice for you. And if selling isn’t the best option, alternatives like non-recourse financing and cashless exercise may provide additional flexibility and benefits to meet your financial needs.

This material, provided by Linqto, is for informational purposes only and is not intended as investment advice or any form of professional guidance. Before making any investment decision, especially in the dynamic field of private markets, it is recommended that you seek advice from professional advisors. The information contained herein does not imply endorsement of any third parties or investment opportunities mentioned. Our market views and investment insights are subject to change and may not always reflect the most current developments. No assumption should be made regarding the profitability of any securities, sectors, or markets discussed. Past performance is not indicative of future results, and investing in private markets involves unique risks, including the potential for loss. Historical and hypothetical performance figures are provided to illustrate possible market behaviors and should not be relied upon as predictions of future performance.

Where can I sell pre-IPO stock?

The secondary market offers a platform for employees and shareholders to sell their pre-IPO shares, providing a solution for those looking to liquidate these assets.

How do I sell in a pre open IPO?

To sell in a pre open IPO, place a sell order with your preferred price via broker or online platform. If the listing price is equal to or higher than the specified price, your shares will be sold at the listing price.

Are pre-IPO shares worth anything?

Pre-IPO shares can be valuable as they reflect ownership in a company before it goes public. Their worth hinges on the company’s growth prospects and success of the eventual IPO. While they offer potential for substantial returns, they also carry risks due to their speculative nature and lack of liquidity.

What is the main difference between selling pre-IPO stock on a secondary market platform and through a tender offer?

Selling pre-IPO stock on a secondary market platform involves connecting sellers with potential buyers, whereas tender offers are company-organized liquidity events that allow shareholders to sell their shares at a predetermined price.