By Ryan Prete, Dec 4, 2023

As the world navigates the complexities of the post-pandemic landscape, global markets in 2024 are approaching a critical phase in the ongoing economic development. While analysts expect economic growth to perform moderately compared to the post-pandemic rebound, there are encouraging signs of resilience and adaptation. Technological advancements, evolving consumer trends, and the ongoing pursuit of sustainable practices are shaping the contours of the global marketplace. Amidst these dynamic forces, investors and businesses alike are seeking strategies to navigate the evolving landscape and capitalize on emerging opportunities. In this article, we’ll revisit the U.S. market’s performance in 2023, discuss how the market climate could look in 2024, and outline sectors that could see a boost in activity in the upcoming year.

Read our blog Shaping the Future: Exploring the 2024 IPO Landscape to learn what lies ahead for public offerings in 2024.

Table of Contents

The U.S. markets experienced a period of notable fluctuation in 2023, marked by periods of volatility and uncertainty amidst a backdrop of rising inflation, interest rate hikes, and geopolitical tensions. Despite these challenges, the markets demonstrated resilience and adaptability, closing the year with positive results.

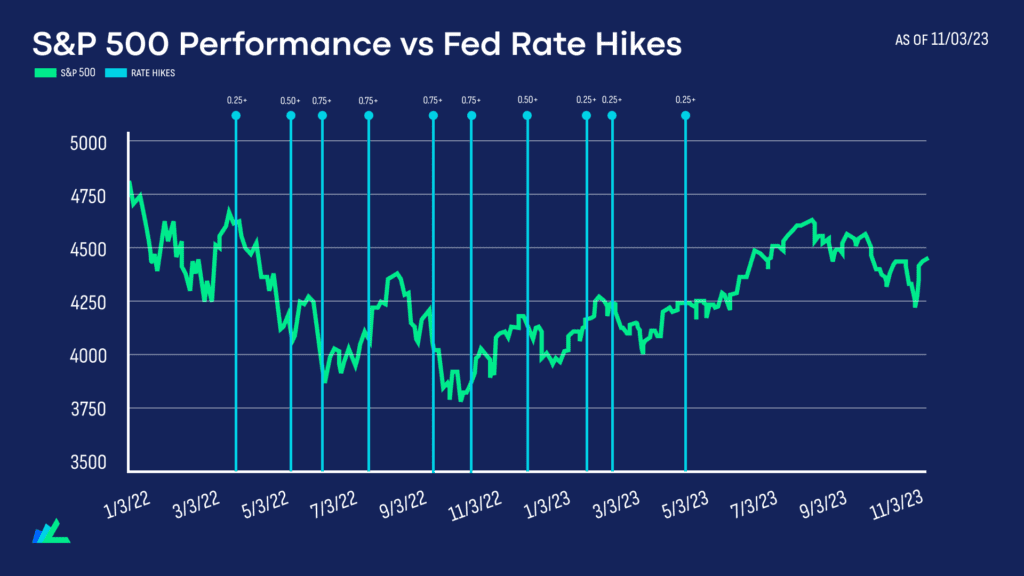

The Federal Reserve’s decision to raise rates four times in 2023–and 11 times since the start of 2022–bringing rates to 5.25%-5.5% greatly affected markets in the first half of the year. The Federal Reserve serves as the U.S.’s central bank, and raises interest rates as it works to combat inflation, often aiming to bring the country’s total inflation rate to about 2%.

When the Fed raises rates, it makes borrowing money more expensive for individuals and businesses. This is because the Fed controls the federal funds rate, which is the rate at which banks lend money to each other overnight. When the Fed raises the federal funds rate, banks charge higher interest rates on loans, meaning borrowing money becomes more expensive.

This can result in slower economic growth, lower consumer spending, and a reduction in the valuation of public stock indices as investors weigh the value of a company’s stock on the expected future earnings of the company.

However, despite the headwinds from the Federal Reserve, the U.S. equity markets managed to post impressive gains in 2023, elevated by a surge in U.S. markets in the second half of the year. The S&P 500 index, a broad measure of the U.S. stock market, was up by nearly 19% year-to-date as of the publishing of this article. The Dow Jones Industrial Average (DJIA)–a stock market index that measures the performance of 30 of the largest U.S. publicly traded companies–was up 6.6% YTD, while the Nasdaq Composite, a tech-heavy index, surged by over 37% YTD.

2023 was a year of contrasts for the U.S. markets, characterized by both turbulence and notable growth. This period was defined by a range of factors that swayed investor sentiment and steered the direction of market movements. Here are four key factors that played a significant role in shaping the U.S. markets in 2023:

Federal Reserve’s Monetary Policy Tightening: The Federal Reserve’s aggressive monetary tightening policy was a dominant theme throughout 2023. As we mentioned above, the Fed raised rates four times in 2023–and eleven times since the start of 2022.

Inflationary Pressures: Inflation peaked at 40-year highs in early 2023, driven by supply chain issues and strong consumer demand. Although it moderated later in the year, its persistence stirred investor concerns and led to expectations of continued Fed intervention.

Geopolitical Tensions: The year saw heightened geopolitical tensions, including the ongoing conflict in Ukraine, and strained US-China relations. These situations, along with the Israel–Hamas war, disrupted energy markets, impacted global trade, and raised concerns about supply chain stability.

Economic Growth Slowdown: Economic growth in the U.S. slowed in 2023, influenced by the impact of interest rate hikes, persistent inflation, and geopolitical tensions. Despite resilience, these factors led to concerns about a potential recession in 2024.

Leverage the power of private equities. Make your move and accelerate your wealth creation journey today!

While it’s difficult to provide future predictions for how the market will perform, analysts are theorizing that the market climate in 2024 could be characterized by cautious optimism amidst lingering uncertainties. While economic growth is projected to be moderate compared to the post-pandemic rebound, there are encouraging signs of resilience and adaptation.

Technological advancements, evolving consumer trends, and the ongoing pursuit of sustainable practices are shaping the contours of the global marketplace. Amidst these dynamic forces, investors and businesses alike are seeking strategies to navigate the evolving landscape and capitalize on emerging opportunities.

One key factor influencing the market climate in 2024 will be inflation trends. Inflationary pressures are expected to gradually ease in 2024, but the pace of moderation remains uncertain. The Fed hasn’t ruled out additional interest rate hikes, despite previous rate increases.

Another crucial factor will be the U.S.’s overall economic growth. Even though the post-pandemic rebound has mostly tapered off, the U.S. economy is expected to remain resilient in 2024; while consumer spending, a major driver of economic growth, is expected to continue, supported by a strong labor market and healthy household balance sheets.

Like they did in 2023, geopolitical dynamics are poised to play a pivotal role in shaping the market climate. Ongoing trade tensions, coupled with the emergence of new geopolitical flashpoints, may introduce elements of unpredictability. The interplay between major economic powers will influence global supply chains, investment flows, and regulatory environments. Navigating these geopolitical currents will demand astute risk management strategies from businesses, while investors may find opportunities amid the turbulence, particularly in sectors aligned with sustainable development goals and technological advancements.

As the so-called “Fourth Industrial Revolution” accelerates, industries are embracing digitalization, artificial intelligence, and automation. Companies that leverage these technologies effectively may gain a competitive edge, while those slow to adapt may face challenges. ESG (Environmental, Social, and Governance) considerations are expected to feature prominently, with sustainable practices becoming increasingly integral to corporate strategies. The intersection of technological innovation and sustainability will not only reshape industries but also redefine the criteria for long-term success in the evolving global market arena.

As the world navigates the complexities of the post-pandemic landscape, U.S. markets in 2024 will be influenced by a multitude of factors, including:

Corporate Earnings: Corporate earnings have historically played a significant role in shaping the performance of U.S. markets. While analysts believe overall economic growth will be moderate next year, a healthy growth trajectory is expected for corporate profits.

The 2024 Election Cycle: The outcome of the 2024 presidential election could have a significant impact on U.S. markets; as indices have been known to greatly fluctuate on election days. Different policies from different candidates could affect corporate taxes, regulations, and trade agreements, which could all have a ripple effect on stock prices.

The Housing Market: The housing market outlook for 2024 is mixed, with some experts predicting a continued slowdown in home price growth and others expecting a modest rebound. Interest rates, home prices, inventory, buyer demand, and affordability levels are all defining factors of the housing market.

Upcoming Federal Reserve Meetings: If the Fed raises interest rates, it could make it more expensive for companies to borrow money, which could hurt economic growth and stock prices.

Geopolitical Events: The continuing wars in Ukraine and The Middle East as well as the ongoing tensions between the U.S. and China could create uncertainty and volatility in the market.

Consumer Trends: Consumer trends are constantly changing and have a significant impact on the market. For example, the growing popularity of online shopping has disrupted the retail industry, while the increasing demand for sustainable products is creating new opportunities for companies in the green economy.

Investor Sentiment: Investor sentiment–the overall mood of the market–can be a powerful force in determining market movements. If investors are optimistic about the future, they are more likely to buy stocks, which can drive up prices.

Share Your Insights: Have thoughts or experiences to share on this topic? Dive into the discussion and leave your insights in the comments section below!

As the investment landscape evolves in 2024, investors might consider several proactive measures to navigate the market effectively and position their portfolios for potential growth. Here are some key strategies to consider:

Stay informed: Regularly read financial news–including Linqto’s blog–follow market analysts to stay on top of the latest developments. This knowledge can aid in making more informed investment decisions and adapt to changing market conditions.

Diversifying portfolios: Diversification across various asset classes of stocks, bonds, real estate, and alternatives are often suggested as a way to potentially reduce risk, It’s important to understand that diversification does not guarantee against loss but may help in managing investment risk.

Understand Market Volatility: Being aware and prepared for potential market volatility is part of strategic investment planning. This may involve adjusting investment strategies to align with one’s risk tolerance.

Adopt a Long-Term Perspective: Focusing on long-term investment goals and avoiding impulsive decisions influenced by short-term market fluctuations can be a sensible approach. This includes evaluating investments based on fundamental analysis and long-term potential.

Learn more about investing in undervalued sectors.

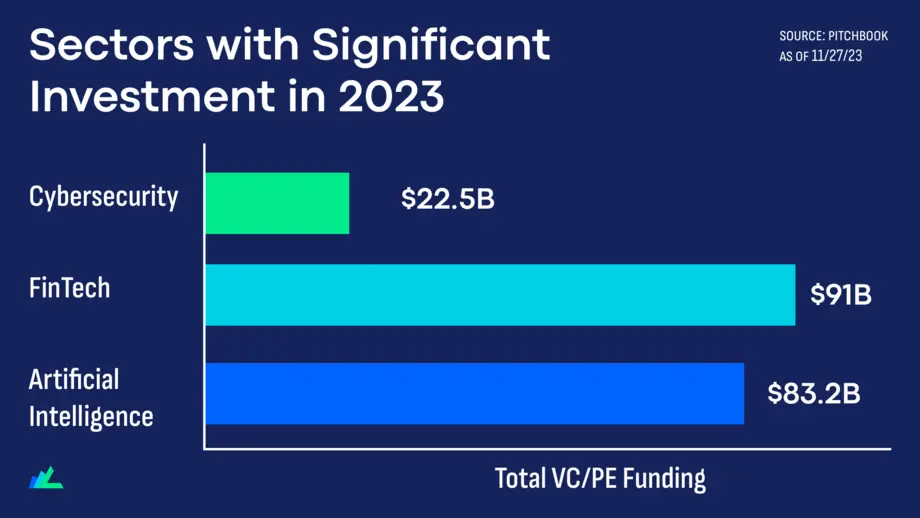

While it’s an arduous task to predict which sectors could out-perform others, public-market data as well as institutional investing metrics signal that these three sectors could continue to dominate markets in 2024:

The artificial intelligence (AI) sector is poised for significant growth in 2024, driven by several factors that are converging to create a favorable environment for innovation and adoption, including:

The increasing availability of data, coupled with advancements in computing power, is providing the fuel for AI algorithms to learn and improve at an unprecedented pace. This is leading to the development of more sophisticated AI applications that can solve complex problems and automate tasks across a wide range of industries.

The growing demand for AI solutions is being fueled by the realization of its transformative potential. Businesses are increasingly recognizing the ability of AI to enhance efficiency, improve decision-making, and create new revenue streams. This is leading to increased investments in AI initiatives across various sectors, including healthcare, manufacturing, finance, and retail.

Governments around the world are recognizing the importance of AI and are taking steps to promote its development and adoption. This includes investing in AI research and development, providing funding for AI startups, and establishing clear guidelines for the ethical use of AI.

The financial technology (fintech) sector–which has a favorite of both public and private institutional and retail investors for the better part of a decade–is projected to be a star sector again in 2024 for a number of reasons:

Consumers and businesses are increasingly comfortable conducting financial transactions online and through mobile devices, seeking convenient, secure, and personalized financial services, which is driving the demand for innovative fintech solutions that cater to the evolving needs of the digital age.

Governments around the world are recognizing the potential of fintech to improve financial inclusion, promote competition, and foster economic growth. This is leading to the development of more supportive regulatory frameworks that facilitate the growth of fintech companies while ensuring consumer protection and financial stability.

Blockchain technology, artificial intelligence, and data analytics are enabling the development of new financial products, services, and business models. These advancements are transforming the way we make payments, manage investments, access credit, and manage our finances.

Step into the high-reward world of private equities. Don’t wait, your portfolio expansion starts here!

Drive by several factors that underscore the ever-increasing importance of protecting data and digital infrastructure, the cybersecurity sector is believed to be a pillar of U.S. markets next year due to the following factors:

As cybercriminals are becoming more adept at exploiting vulnerabilities and devising new attack methods, making it imperative for organizations to stay ahead of the curve and implement effective cybersecurity measures. This is driving demand for advanced cybersecurity solutions, including threat detection and prevention systems, data encryption tools, and security awareness training.

As more businesses and organizations shift to online platforms and adopt cloud-based technologies, the number of potential cyberattack targets surges. This calls for comprehensive cybersecurity strategies that encompass network security, endpoint security, and cloud security.

Cyberattacks can have devastating financial consequences for organizations, resulting in data breaches, operational downtime, and reputational damage. This compels businesses to invest heavily in cybersecurity to safeguard their assets and reduce the risk of costly cyber incidents.

As we anticipate the unfolding of 2024, the market continues to be a tapestry of evolving trends influenced by technological advancements, consumer preferences, and global dynamics. Predicting the future remains a complex endeavor, but the insights and trends we’ve explored provide valuable guidance for understanding potential market directions. These insights are important in navigating the ever-changing investment landscape.

Whether it’s capitalizing on the growth potential in sectors like AI, Fintech, or Cybersecurity, or fortifying portfolios against market volatilities, staying informed and adaptable is essential. We encourage you to continue engaging with our platform, where informed decision-making and strategic investment align with the possibilities presented by the market’s evolution.

Investing in 2024 and the years to follow is about more than just weathering challenges; it’s about embracing the opportunities that align with your investment goals and principles. We are excited to support you on this journey, helping you make the most of the opportunities that lie ahead.

This material, provided by Linqto, is for informational purposes only and is not intended as investment advice or any form of professional guidance. Before making any investment decision, especially in the dynamic field of private markets, it is recommended that you seek advice from professional advisors. The information contained herein does not imply endorsement of any third parties or investment opportunities mentioned. Our market views and investment insights are subject to change and may not always reflect the most current developments. No assumption should be made regarding the profitability of any securities, sectors, or markets discussed. Past performance is not indicative of future results, and investing in private markets involves unique risks, including the potential for loss. Historical and hypothetical performance figures are provided to illustrate possible market behaviors and should not be relied upon as predictions of future performance.