By Ryan Prete, Nov 20, 2023

Initial Public Offerings (IPOs) remain pivotal events that can generate significant interest from investors. As economic trends, regulations, and company ambitions evolve, analyzing the IPO climate becomes important for capitalizing on emerging opportunities. This article explores IPO dynamics and the potential 2024 landscape, examining factors influencing market sentiment, technology’s role, and implications across sectors.

For a comprehensive understanding of how to buy pre-IPO stock, our detailed guide offers in-depth insights and practical advice.

The IPO market in 2023 has overall been mostly muted, with fewer deals and proceeds raised than in previous years. However, some analysts see potential signs of improvement, with deal activity potentially picking up in the third quarter and several high-profile deals in the pipeline.

According to EY, there have been 968 IPOs globally in the first three quarters of 2023, raising $101.2 billion in capital. This represents an approximately 5% decrease in volume and an approximately 32% decrease in proceeds year-over-year. Contributing factors to the slowdown include rising interest rates, inflation, and geopolitical uncertainty. These factors have made investors more cautious and have increased the cost of capital for companies.

The U.S. IPO market has also been lackluster in 2023, with fewer deals and proceeds raised than in previous years. However, there are signs of improvement, with deal activity picking up in the third quarter and several high-profile deals in the pipeline. According to Renaissance Capital, there have been 137 IPOs on U.S. exchanges in 2023 so far, raising $29.2 billion. This represents an approximately 20% decrease in volume and an approximately 40% decrease in proceeds year-over-year.

Leverage the power of private equities. Make your move and accelerate your wealth creation journey today!

The slowdown in IPO activity in the U.S. is largely due to the same factors that have affected the global IPO market. However, there are some additional factors that have weighed on the U.S. IPO market, such as the regulatory uncertainty surrounding SPACs.

Despite the slowdown in IPO activity, there have been a number of notable IPOs in 2023, including Arm–the British semiconductor company that raised $4.9 billion in the largest tech IPO of the year–and Instacart–the grocery delivery company that raised $2.6 billion in its IPO.

Despite 2023’s uninspiring IPO performance, there are signs of improvement, with deal activity picking up in the third quarter and several high-profile deals in the pipeline. Some analysts express optimism about the IPO market in 2024, but they are also cautioning investors that the market is likely to remain volatile.

The IPO outlook for U.S. markets in 2024 is mixed. There are a number of factors that could support an IPO rebound, such as improved economic conditions, increased demand for growth stocks, and pent-up demand from companies that have been waiting to go public. On the other hand, there are also some factors that could weigh on the market, such as rising interest rates, inflation, and geopolitical uncertainty.

Overall, analysts are generally optimistic about the IPO market in 2024, but they are also cautioning investors that the market is likely to remain volatile. Investors should carefully consider their risk tolerance and investment goals before investing in IPOs.

Here are some factors that could affect the U.S. IPO market in 2024.

Economic conditions: If the U.S. economy continues to recover in 2024, this could lead to improved investor sentiment and a greater appetite for risk. This could lead to more investors being open to investing in IPOs.

Interest rates: The U.S. Federal Reserve is expected to continue raising interest rates in 2024. This will increase the cost of capital for companies and could make investors more cautious about investing in IPOs. However, if economic conditions improve, investors may be willing to look past higher interest rates and invest in IPOs that offer the potential for high returns.

Inflation: Inflation is expected to remain elevated in 2024, which could erode corporate earnings and make IPOs less attractive to investors. However, if inflation begins to moderate in 2024, this could be a positive catalyst for the IPO market.

Geopolitical uncertainty: The ongoing war in Ukraine and other geopolitical tensions could continue to weigh on investor sentiment and make investors more cautious about investing in IPOs. However, if geopolitical tensions ease in 2024, this could be a positive catalyst for the IPO market.

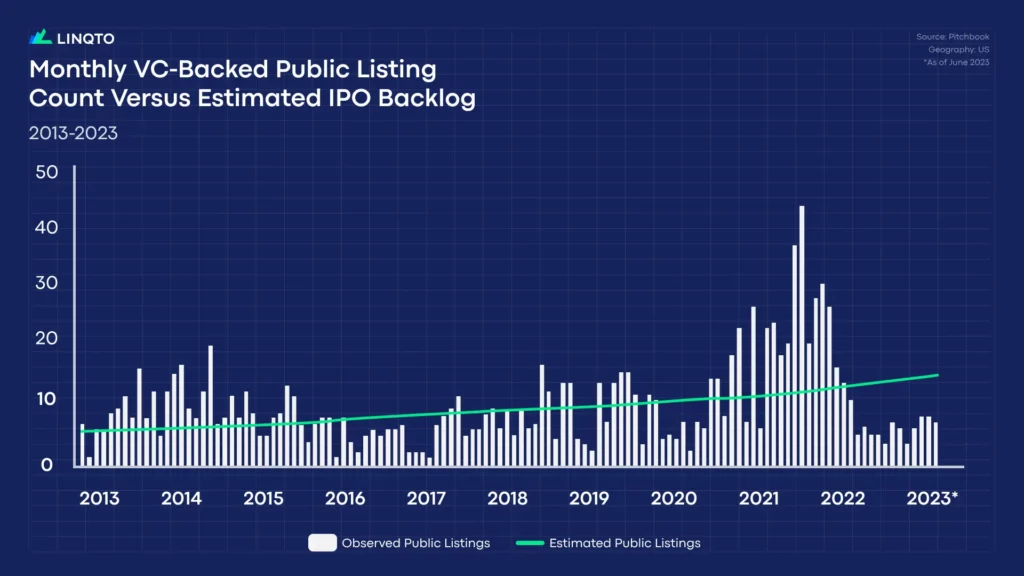

Pent-up demand: There are a number of companies that have been waiting to go public, but have been delayed by the challenging market conditions in 2023. These companies could be eager to go public in 2024 if market conditions improve.

Discover essential strategies for how to sell pre-IPO stock in our thorough guide, offering valuable insights and practical tips.

Similar to the U.S. IPO climate expectations, market analysts are projecting a potential IPO rebound for European markets next year. Some analysts predict a 10% increase in activity and a 20% increase in proceeds raised year-over-year. Analyst expectations are based on improved economic conditions, increased demand for growth stocks, and pent-up demand from companies that have been waiting to go public.

However, there are also some potential headwinds that could weigh on the market, such as rising interest rates, inflation, and the ongoing war in Ukraine. Overall, analysts are cautiously optimistic about the European IPO market in 2024.

Share Your Insights: Have thoughts or experiences to share on this topic? Dive into the discussion and leave your insights in the comments section below!

Recognizing potential signs of a U.S. market uptick could be useful for informed investor decisions. While market conditions are influenced by numerous factors and can be subject to sudden changes, several indicators can hint at a potential upward trend, including:

Positive Economic Data: Improvements in economic indicators, such as GDP growth, employment rates, and consumer spending, can signal a healthy economic environment, often translating into a positive impact on the stock market.

Bullish Technical Indicators: Technical analysis tools, such as moving averages, relative strength indicators (RSI), and MACD (Moving Average Convergence Divergence), can provide insights into the overall market direction and potential trend reversals.

Decrease in Volatility: A decline in market volatility, as measured by indices like the VIX (Volatility Index), may indicate a more stable environment, potentially signaling an uptick in the markets.

Inflow of Institutional Investments: Increased participation from institutional investors, such as mutual funds, hedge funds, and pension funds, can suggest growing confidence in the market and contribute to an upward trajectory.

Mergers and Acquisitions Activity: Heightened M&A activity can indicate that companies are optimistic about future growth prospects, potentially reflecting positively on market sentiment.

Political Stability: Political stability and policy continuity can positively influence investor confidence. Clarity on government policies and a lack of geopolitical uncertainties can create a favorable backdrop for market growth.

Let’s explore some IPO prospects and potential market entries across these dynamic sectors: cybersecurity, digital assets, cryptocurrency, and artificial intelligence. Each of the companies below are either reportedly considering an IPO, or could make the push to go public next year.

Stripe: Stripe is a global technology company that specializes in online payment processing for internet businesses. Founded in 2010, Stripe has become a leading player in the fintech industry, offering payment solutions that streamline online transactions for businesses of all sizes.

Klarna: Klarna is a Swedish fintech giant that has gained prominence for its “buy now, pay later” service, allowing consumers to make online purchases with the option to pay in installments. Founded in 2005, Klarna has become a major player in the e-commerce space, offering a range of payment solutions to enhance the shopping experience for millions of users globally.

Armis: Armis is a cybersecurity company that provides asset inventory and security monitoring for IoT devices. Armis’s platform provides visibility into all connected devices on a network, including their security posture. Armis also provides alerts and recommendations to help organizations mitigate security risks.

Snyk: Synk is a cybersecurity company focused on providing solutions for managing and securing open-source code in software development. Founded in 2015, Synk offers tools to identify and address vulnerabilities in open-source dependencies, helping developers create more secure and resilient software applications. Please note that developments may have occurred since my last update.

Step into the high-reward world of private equities. Don’t wait, your portfolio expansion starts here!

Circle: Circle is a fintech company that has made a significant impact in the cryptocurrency space. Known for its stablecoin, USDC (USD Coin), Circle provides a platform that facilitates seamless transactions and enables individuals and businesses to engage in secure and transparent digital asset transfers.

OpenSea: OpenSea is a leading online marketplace for buying and selling non-fungible tokens (NFTs), representing unique digital assets like digital art, collectibles, and virtual real estate. Launched in 2017, OpenSea has played a pivotal role in the booming NFT space, providing a platform for creators and collectors to engage in the trade of digital assets on the blockchain.

OpenAI: OpenAI is an artificial intelligence research laboratory founded in 2015, encompassing both the for-profit entity OpenAI LP and the non-profit OpenAI Inc. The organization is known for its language models, including ChatGPT, which stands as a prominent example of OpenAI’s work in developing advanced natural language processing capabilities.

Dataiku: Dataiku is a software and AI company specializing in collaborative data science and machine learning platforms. Established in 2013, Dataiku’s platform enables organizations to develop, deploy, and manage advanced analytics and machine learning models for data-driven decision-making.

Reddit: Reddit is a social media platform and online community where users can share content, participate in discussions, and vote on posts and comments. Founded in 2005, Reddit has grown into one of the largest and most diverse online communities, covering a vast array of topics and interests.

Impossible Foods: Impossible Foods is a California-based food technology company founded in 2011, renowned for its innovative plant-based meat substitutes. Their flagship product, the Impossible Burger, has gained widespread popularity for replicating the taste and texture of traditional beef burgers using plant-derived ingredients.

As 2024 approaches, the IPO landscape may continue to evolve. New companies in sectors like healthcare, technology, fintech and digital assets are emerging as potential candidates for future public offerings. The interplay of economic forces, technological innovations, and investor sentiment shifts may shape an IPO market where companies across industries consider going public. As investors and stakeholders look ahead, remaining agile, informed, and attuned to the evolving trends will be important to navigating a dynamic IPO space.

This material, provided by Linqto, is for informational purposes only and is not intended as investment advice or any form of professional guidance. Before making any investment decision, especially in the dynamic field of private markets, it is recommended that you seek advice from professional advisors. The information contained herein does not imply endorsement of any third parties or investment opportunities mentioned. Our market views and investment insights are subject to change and may not always reflect the most current developments. No assumption should be made regarding the profitability of any securities, sectors, or markets discussed. Past performance is not indicative of future results, and investing in private markets involves unique risks, including the potential for loss. Historical and hypothetical performance figures are provided to illustrate possible market behaviors and should not be relied upon as predictions of future performance.